Commercial Real Estate is Fine (An April Fool's Piece)

commercial real estate, bank runs, and belief

Bank Collapse, the Fragile Dominoes

With the recent bank collapses in the United States, fear has spread around small, mid-sized, and regional banks in the country. It’s clear that bank runs pose a problem and can quickly lead to insolvency.

You’d think that after 200 years of this recurring phenomenon, someone would have found a solution to this. Unfortunately, we don’t learn from our mistakes, and in this current environment, banks are susceptible to looming distress.

But there’s another wrecking ball on the horizon — Commercial Real Estate — and it’s likely to hit smaller banks the hardest. They’re fragile, and a light touch can cause the dominoes to fall. Whispers of bank runs can lead to bank runs, that’s what happened with Silicon Valley Bank, and right now the whispers scream that small banks are struggling in the commercial real estate space.

The Size of the Industry, and Small Banks Holding the Bag

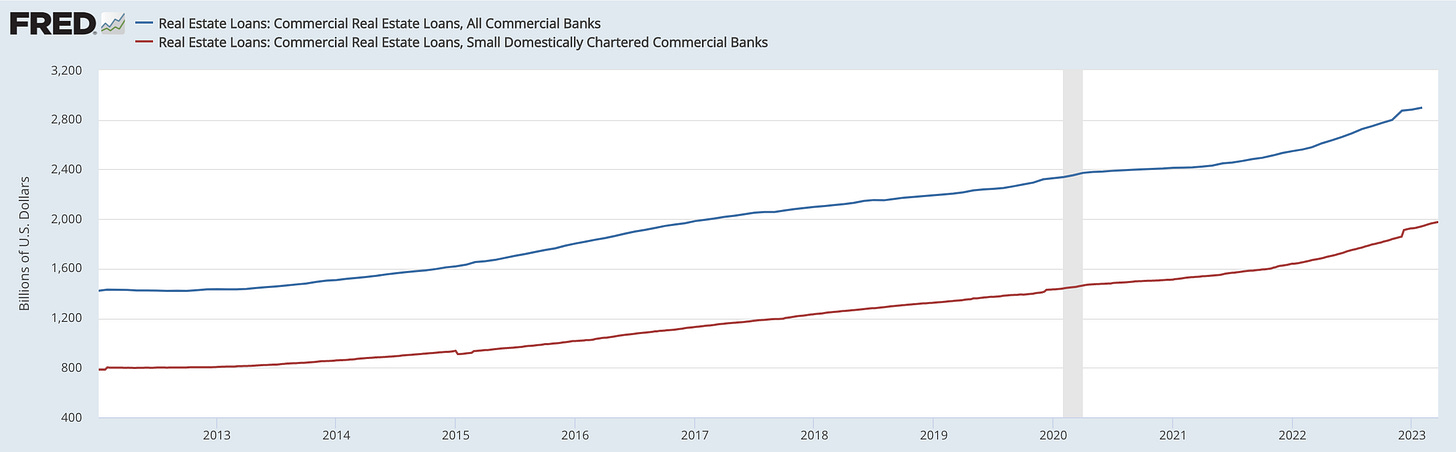

It’s really big. The entirety of the commercial real estate industry is estimated to be over $20 trillion (here). There’s $2.9 trillion of CRE debt held on commercial bank balance sheets. But Commercial Real Estate is a very fragmented industry!

Small and Regional banks take up a good chunk of the space, pulling away from the monoliths. Of that $2.9 trillion in mortgage debt, about $2 trillion is held by small domestically chartered commercial banks — which is effectively a fancy way of saying banks not in the Top 25 list.

This implies that small banks currently hold about 67% of commercial real estate loans (here). This is significantly skewed from their greater participation in the banking industry, where they hold 38% of loans outstanding. And that’s really bad! The banks that can afford it the least are tied up in CRE risk the most!

So what do these banks have to pay? From Bloomberg’s Odd Lots podcast (here) —

About 15-20% of maturing debt is coming due each year over the next five years, with an average of $500 billion per year. Most of the debt coming due in 2023 were loans originated in 2013 or 2018. Property prices have risen since 2013, so the effective LTV is actually lower than 50-60% for those who originated a loan in 2022 when buying a property.

Over half of that debt is held on bank balance sheets, primarily small bank balance sheets. We can extrapolate about $150 billion coming due for these smaller banks.

The problem is that parts of the asset class are rapidly weakening. Higher interest rates and hybrid work-from-home models mean that office space is becoming more expensive and generating less revenue.

How Did We Get Here? Relationships.

Small and regional banks do a lot more for their communities than big banks. They want to work with borrowers that can provide activity and productivity to their communities.

It’s a relationship game. Small banks can help fund businesses that’ll improve economies and provide jobs in local areas. In turn, this will generate future lending opportunities for said banks. It’s the lending cycle that can actually help small towns and municipalities. This cycle often leads local banks to lend under more favorable conditions, because ultimately they care more than the big banks.

Better rates, non-recourse loans, future promises, etc. It’s about establishing and maintaining relationships and keeping communities tight. There is some incentive to do good, this is not the case for larger banks.

It’s Not All Bad, It’s Not All Office Space

The silver lining in all of this is that it’s not all bad. The commercial real estate space covers several different property types. The majority of the distress falls under office space, but looking at it through this lens disregards a massive chunk of the industry. Commercial Real Estate also covers hotels, data centers, healthcare space, multifamily, strip malls, etc. The list goes on.

Fundamental drivers vary wildly across all these sub-sectors. What might be negatively impacting office space might not be impacting data centers. The industry is diversified within its own umbrella, and that eases some pressure when we talk about loan amounts across all of CRE.

Of the $270 billion in bank loans coming due in commercial real estate, roughly $80 billion is in the office space. That’s definitely bad, but it’s not BAD. And it’s spread across thousands of banks. What would pose the biggest issue here is if loan defaults drag property prices down. It does seem as though that wave is picking up. Public indices are showing a halt in prices of commercial real estate starting in Q4 of 2022. Private markets tend to lag public markets, so seeing individual property prices coming down would be a logical conclusion.

Give Me My Money

The point of this whole thing was to highlight an implied fear — if my bank is in trouble, I’m pulling my money out. It doesn’t actually matter if my bank is in trouble, it just matters that I think my bank is in trouble. And if everyone thinks their bank is in trouble, then the bank will in fact be in trouble.

Rising rates have slammed bond prices, and a lot of smaller banks are holding longer dated treasuries! It’s the perfect bank run set up. All these commercial real estate pieces floating around are definitely scary, but I’m not sure the fundamental issue is strong enough to bring banks down. However, if people believe that this issue is big enough, their belief will only exacerbate it.

Their belief is gravity. And that can lead to contagion.

The End

If you made it this far, hope you’re thriving, hope you enjoyed the piece, I’ll be writing more on topics that interest me so go ahead and give me a follow if you so please. Thanks for reading!