Cormac McCarthy has this quote in his book All The Pretty Horses —

He stood at the window of the empty cafe and watched the activities in the square and he said that it was good that God kept the truths of life from the young as they were starting out or else they'd have no heart to start at all.

Hope is a funny thing. For many Americans, hope of one day owning a home is a guiding factor in how they live their lives — what career paths they choose, where they want to settle down, whether or not they want to start a family.

It’s the American dream, after all — but it’s growing harder to achieve, and people are losing hope. The American dream feels a little bit like that quote. The truths of home ownership have been twisted; more and more young people are losing the heart to start in that pursuit at all.

You need a spark to get moving; you need a flame to have the heart to start. That flame is slowly dying, here’s why.

Homes Are Expensive

Homes in the United States are very expensive; the most expensive they’ve ever been, in fact. Housing is far-and-beyond the largest expense for most Americans, with the median renter spending about one-third of their income on housing costs1.

Because housing is a basic necessity, it’s an unavoidable cost. Unlike your favorite cup of coffee that went from $3.50 to $6 in the last four years — which you can promptly avoid if you so choose — housing is necessary. There is no avoiding it. This means that when the price of housing goes up, everyone is affected — some significantly more-so than others. Because everyone falls under the housing umbrella, the housing market dictates how people feel in a very meaningful way. In fact, the housing market dictates almost everything about a person’s life in a very meaningful way.

Where you live dictates how much you walk, where your kids can go to school, whether or not you can frequently see your friends, how much you participate in the economy, what your commute looks like, how much you contribute to pollution, and more — just to name a few. How much you pay for your housing situation is going to affect how much you can contribute to your own retirement, how much money you spend, whether or not you commit tax fraud (kidding), whether or not you can save for your child’s college fund, the list goes on.

It’s instrumental for the well-being of an entire country to have a healthy housing market. If we can solve the housing crisis, almost every material aspect of life for everyone would become substantially better.

So why is housing so damn expensive and how can we make it more affordable? To tackle the former, we need to look at supply and demand — the dictators of market forces. Let’s focus on supply.

Supply

We have no housing. That’s it. That’s basically the root of the issue. We can look at the causes of the supply issue as two major buckets.

No one wants to sell.

No one wants to build.

No one wants to sell.

There are two primary statistics that tie into this.

Roughly 40% of U.S homes are paid-off, mortgage-free2. This is A LOT OF HOMES.

About 22% of mortgages have an interest rate below 3%, this is VERY low — historically almost unheard of. (And 60% of mortgages have an interest rate below 4%) 3

A round of applause for these people! They’ve either achieved the American Dream of owning a home, or achieved ever elusive sub-3% mortgage rate, which is a dream of its own. This is great for them, but comes with several implications. First and foremost, why would any of these people want to sell? They’ve managed an exceptional interest rate or flat out ownership, and would almost certainly be downsizing given today’s market and interest rates. A working paper by the Federal Housing Finance Agency found:

For every percentage point that market mortgage rates exceed the origination interest rate, the probability of sale is decreased by 18.1%.

Mortgage rates are currently at 7%. It would be ~crazy~ for someone to give up their 3% mortgage in today’s environment. To give a concrete example:

A $400,000 dollar mortgage at a 3% interest rate equals a $1,686 dollar monthly payment

A $400,000 dollar mortgage at a 7% interest rate equals a $2,661 dollar monthly payment

The four percent difference across the two mortgages leads to a 57% increase in the mortgage payment! That’s ummm absolutely insane?

It makes sense why people who own homes that are either paid-off or locked-in at a low interest rate would want to avoid re-entering the market now. This is known as the “Lock-In” effect. Of course, mortgage rates aren’t the only factor that go into the decision of buying a house. These things are far more nuanced — does the family want to up-size, do they like their current home, do they want to be closer to work, etc. There are a lot of variables that go into the decision, but money is certainly one them.

This is all supply restriction caused by a lack of willingness to sell given current market conditions, but there’s an even bigger catalyst for supply shock.

No one wants to build.

The U.S is short about four to seven million homes according to a wide range of estimates. There is not enough housing. There isn’t any magical explanation for this; the country just hasn’t built enough homes to keep up with demand. Now the explanation as to WHY the country hasn’t built enough homes, that’s a magical explanation.

There are two main culprits:

Zoning

People who don’t want you to build more housing

Zoning

For those who don’t know what zoning is — a municipality basically takes a map of certain districts and then slices up that district into “zones”. Each zone will have specific regulations regarding what can and cannot be built on that land.

The three primary types of “zones” are residential, commercial, and industrial. However, there are sub-divisions within each of those buckets, and they get VERY specific — down to things like car washes and cafes.

Zoning made some sense at first — you wouldn’t want a toxic chemical plant built next to a preschool. That’s objectively a bad idea, and zoning was a way to prevent that. You could say, “The school will go in this zone that permits schools and the toxic chemical plant will go in this other zone very far away.” That’s all great and reasonable.

However zoning was quickly repurposed as a mechanism for keeping out lower income households from any given area. By only allowing primarily single family houses to be built in certain residential zones, house prices started to increase and push out lower-income, often minority, households. This is where zoning took a turn, largely due to a supreme court case back in 1926, which I won’t get into — point being, it was a long time ago.

The past century since then has seen zoning laws that have turned increasingly harmful to the many. If we look at Los Angeles as an example, we see that 78% of all residential land has been reserved for single family homes. That’s ridiculous. Here’s a chart from the Other & Belonging institute at Berkeley highlighting all the single family zoning in Greater Los Angeles4:

To say that you can really only build detached, single family homes that require a specific amount of parking spaces everywhere that is highlighted pink is… ummm… crazy? No duplexes, triplexes, townhomes… NO APARTMENTS? You want a way to constrict housing supply? Single family zoning will do the trick.

This is a widespread issue, affecting many major cities in the country. The NY Times ran an analysis in 2019, and Los Angeles isn’t even the worst of it. In Seattle, 81% of the residential land was zoned for single family homes, in Charlotte, NC that was 84% and in San Jose, CA that was 94%!5

People who don’t want you to build more housing

This brings me to my next point — people who don’t want you to build more housing. The proper terminology for this is the NIMBYs — the Not In My Backyard types.

One of the mechanisms by which the NIMBYs operate is the ever riveting city council meeting. These meetings provide a space where a select few people can make unbelievably consequential decisions on behalf of an entire city. To take from a Pew Trusts paper: 6

In Philadelphia, the vast majority of land use decisions, small or momentous, are made individually by City Council’s 10 members

These council members can invoke what is known as “councilmanic prerogative”, where they say “hey we actually know what’s best for the city, we know what we should and shouldn’t build” and then they make the decision, just the 10 of them. They can decide on where bike lanes go, how parking requirements should be structured, how unused public land can be sold to private parties, and more. There are similar processes in place in other cities too. The council members often invoke prerogative, and rarely disagree with each other.

It’s so crazy that municipalities actively avoid having things like coffee shops and grocery stores in the suburbs of their cities. If you want a cappuccino, you HAVE to get in your car and drive ten minutes out. I get not wanting a skyscraper next to your house — but really? No coffee shops or bike lanes or grocery stores?

All of the above has led to the 2010s being a decade with significant lack of housing units completed.

Substantially fewer housing units built, with substantially greater demand for housing, leads to substantially higher house prices.

It’s sort of been a perfect storm brewing on the housing front, and the last four years we’ve really seen the lightning. Lower interest rates, work from home, high inflation, supply shortage, zoning — it all led us to where we are today. Insanely expensive houses.

Things Are Getting Better

It’s not all bad news. There is room for hope, there is a necessity for it, and things are getting better.

We’re building more apartments! As Jay Parsons writes in this tweet:

The U.S. is adding more new apartments in the first half of 2024 than we did in most FULL CALENDAR YEARS over the last 3 decades, and yet demand is (almost) keeping pace.

As a result, we’ve actually seen falling rent prices in many metropolitan cities this year — primarily in cities that built a lot of apartments in the last four years.

There’s also a stark outlier in real estate — commercial buildings. As work-from-home took shape and anchored itself in modern work culture, people stopped going to the office. Many of these commercial buildings have astounding vacancy rates, and there are government plans that are allocating money toward commercial-to-residential conversions.

We’ve seen that even building luxury apartment units will tilt supply such that rental prices go down for everyone. Jay Parsons again points out:

When you build "luxury" new apartments in big numbers, the influx of supply puts downward pressure on rents at all price points -- even in the lowest-priced Class C rentals.

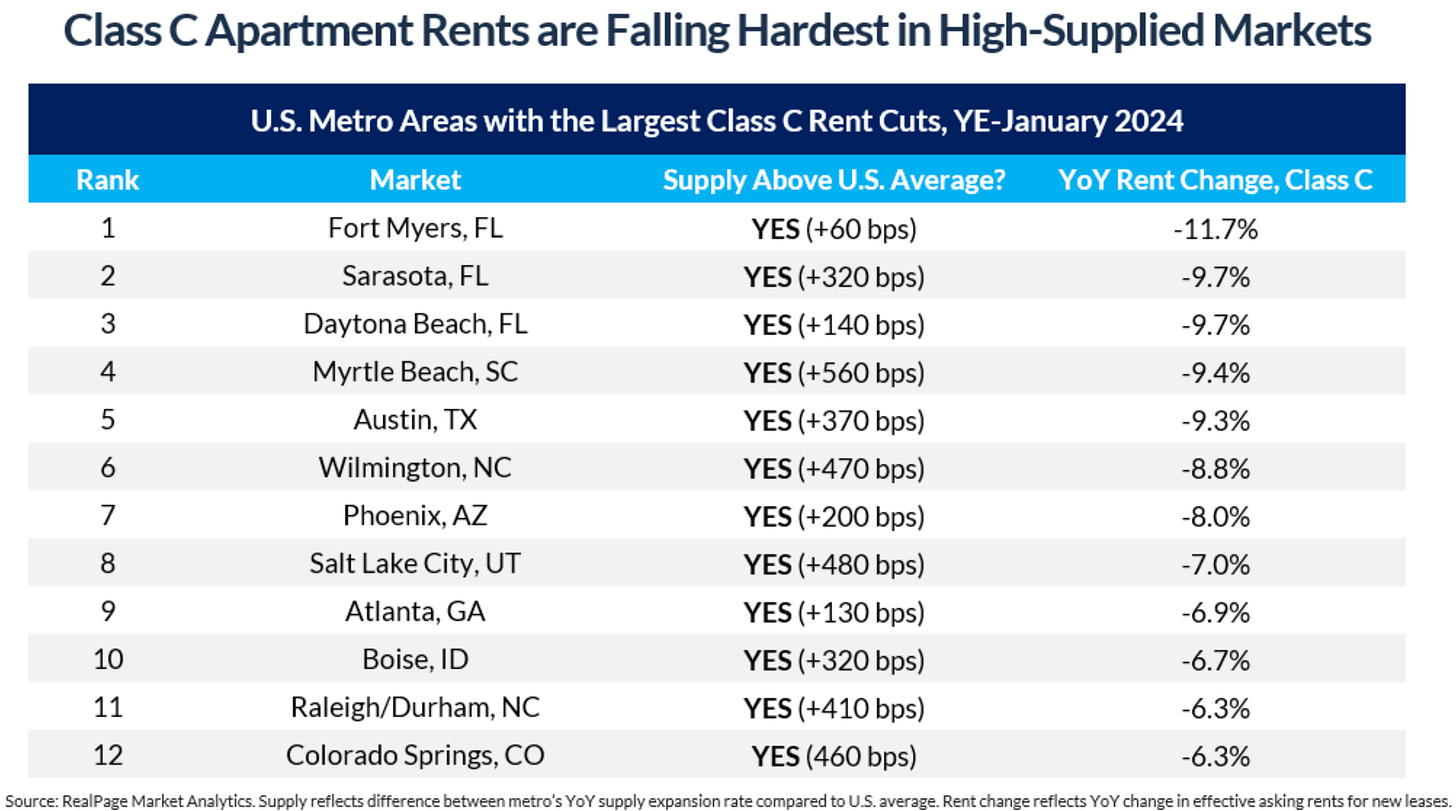

Here's evidence of that happening right now: There are 12 U.S. markets where Class C rents are falling at least 6% YoY. What is the common denominator? You guessed it: Supply. All 12 have supply expansion rates ABOVE the U.S. average.

We need. to. build. And we are. And there is hope.

On Hope

The stories we tell ourselves, they consume our reality. Hope is our lifeline, but it must not stand alone, for hope without reason or logic is blind faith. And blind faith has it’s place, but it is no replacement; it is not to serve as a guide for our lives.

To return to the book that I opened with, All The Pretty Horses — Cormac McCarthy writes:

Between the wish and the thing the world lies waiting.

The world is really big, and the world will make you cynical if you let it. But you have an entire life to live. Regardless of whether the wish or the thing is achieved, you have the world, and that, debatably, is better.

Maria Popova has a great piece on hope, I urge you to read the whole thing. In a world full of negativity bias and horrid news, perhaps here is an antidote:

What we need, then, are writers like William Faulkner, who came of age in a brothel, saw humanity at its most depraved, and yet managed to maintain his faith in the human spirit. In his Nobel Prize acceptance speech, he asserted that the writer’s duty is “to help man endure by lifting his heart.”

In contemporary commercial media, driven by private interest, this responsibility to work in the public interest and for the public good recedes into the background. And yet I continue to stand with E.B. White, who so memorably asserted that “writers do not merely reflect and interpret life, they inform and shape life”; that the role of the writer is “to lift people up, not lower them down.”

I want to leave you with the same sentence that Maria Popova left her readers with in that article:

There is so much goodness in the world — all we have to do is remind one another of it, show up for it, and refuse to leave.

I know this is about housing, but so it is about hope.

Thanks for reading, and I hope you’re doin well.