We ChatGPT'd Our Way Into A Trade War

what the tariffs mean, how they were calculated, and answering some common doubts

The Big Tariff Sign

This week the Trump Administration ushered in a new world order by announcing one of the largest tariff hikes in the history of the United States. This new tax policy affects every single country in the world, because it applies a blanket tariff of at least 10% to every single country in the world (except Canada and Mexico).

There is a fundamental misunderstanding of tariffs, so lets knock the big questions out of the way, and then get more granular from there —

Payment — who pays for tariffs?

The importer of the good pays for the tariff on that good. However, here is empirical research showing the the passthrough rate for tariffs is nearly 100%. This suggests that the ultimate burden of tariffs falls on the consumer, you and I.

Purpose — why enact tariffs?

Lots of arguments here — can we re-shore our manufacturing base to strengthen the middle class, where did American factory jobs go, is global trade the reason I can’t afford a house?

I’ll touch on this in depth later on, but the short of it is that it’s complicated, and broad sweeping tariffs are not the solution

Posture — how do they make the United States look on a global stage?

Heading into the Trump administration, many thought the tariffs were a bluff, negotiating tactic, etc. It is a sign of strength to announce such tariffs — to say “we don’t need the rest of the word”! But that strength can quickly turn to weakness if we are fighting every country at the same time — if we are pushing away our friends closer to our enemies.

I’d like to clear some of this up and expand on why I think Trump’s tariffs don’t make a lot of sense. Here he is flaunting his Big Tariff Sign during the live White House announcement, looking proudly at the tariff rate that the United States will impose against all countries — with no regard whatsoever to the relationships, good will, or mutual trade benefit that we may or may not have with the receiving country.

The Trump administration deems these to be reciprocal tariffs, with a default 10% blanket tax on all trade against every country. What that means is the administration would:

Take the effective tariff rate that the other country has set against the United States

Cut that rate in half to define a new tariff rate

Apply that new rate against the other corresponding country

The administration has labeled these as “kind” tariffs because the United States, out of the goodness of her heart, is cutting the reciprocal tariff rate in half.

There’s a lot to unpack here.

When the Big Tariff Sign was unveiled, this was my exact thought process:

Oh my God these are really big numbers.

Wait what? We’re setting a 24% tariff on Japan?

Why does it say that Japan has a 46% tariff rate against the United States? I know for a fact that’s not true.

Oh my God these numbers are entirely fabricated.

And that’s the short of it — these numbers are entirely fabricated tariff rates and grounded far from reality of international trade. So how did we get here, and what can we expect?

The ChatGPT to Trade Ware Pipeline

The numbers on the Big Tariff Sign do not represent the tariffs that other countries have against the United States. What they do represent is the the trade deficit we have with a country as a percentage of that country’s total exports to the United States. And there’s a chance the ChatGPT is what got us here.

For example, the EU exports $532B to the US and it imports $334B from the US. This means that the United States has a trade deficit of about $198B ($532B - $334B) with the EU. The trade deficit divided by the EU’s total exports to America is about 37%, which is very close to what the administration claims that the EU taxes the US. Below is a chart of all the tariffs the administration had on their Big Tariff Sign on the first column, and the trade deficit as a percent of the country’s exports (i.e America’s imports) on the third column.

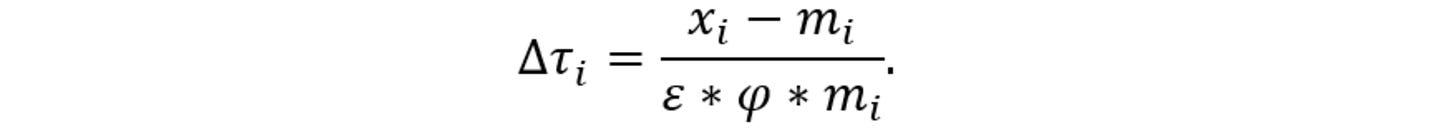

In fact, a statistical analysis shows that we can predict the exact tariff rate that the administration claims other country’s have on the US by using this formula.

I want to be very clear. These numbers that the Trump Administration held up on their Big Tariff Sign are simply… not the tariff rates that other countries have in place against America.

ChatGPT

ChatGPT has been a transformative technology over the past two years. I fear we may have gone too far. When asked for a rudimentary way of determining a tariff rate, this is how the Large Language Model responds:

This is… the exact formula the administration used in order to calculate the numbers on their tariff board. We know this because the White House published their calculation:

They even tried to fancy it up by including the Epsilon and Phi variables in order to account for elasticity in demand and price, which they promptly determined should be equal to 4 and 1/4, respectively. This means that the only two variables that would make the tariff calculation more appropriate for specific countries were assigned values that cancel each other out.

I say this all tongue-in-cheek. I don’t ACTUALLY believe the administration used ChatGPT to come up with their tariff plans… unless…

Brain Rot

Madagascar

This is brain rotting for many reasons, but the most straightforward is that it implies trade will only be “fair” once the trade deficit is closed with every single country. This is nonsensical because when the American companies buy something from another country, they do so because they can get a much better deal. Implying that those countries need to buy the same amount from the United States is not good economics.

For example, the United States has a trading relationship with Madagascar. Last year, we imported roughly $730M from the island, mostly from things like clothing and spices and vanilla. We did so because we don’t grow very much vanilla in the United States and because we are a rich country, with a high cost of labor, where paying people minimum wage to run a textile plant wouldn’t make much sense. We can get cheap goods and spices from Madagascar, and that’s great for America!

Madagascar, on the other hand, is not nearly as wealthy as the United States. They imported about $73M from us last year, not nearly as much as we bought from them! But that’s because the things we make here are more expensive because the U.S is a wealthy nation that pays higher wages. As a result, we have a huge trade deficit with Madagascar. This trade deficit leads the White House to claim that there is a 93% tariff imposed on the United States by Madagascar, and that somehow by reciprocating the tariffs the United States will be better off.

But this nonsense. We benefit from trade with Madagascar; we buy from them things that we cannot produce here. A blanket tariff hurts the United States because it puts inflationary pressures on things like vanilla, and it hurts Madagascar because weakening the American consumer with higher prices means we would buy less from them, impacting their topline as well. Constricting free trade is not helpful in this case.

Guatemala

The flip side of this is that if we were to run a trade SURPLUS with another country, then they theoretically have the upper hand. We can look towards Guatemala for this. They buy more from the United States than the United States buys from them. The American Dream! A trade surplus! However, we are STILL levying a tariff against them.

There seems to be so little care for this policy. Like someone scrambled it together the night before the announcement. Per the administrations logic, we are ripping Guatemala off by having them import more from us than we do from them. But that’s not the criteria for injustice — that is the criteria for free trade.

The Heard and McDonald Islands

Another example of how little regard there was to this tariff policy is what we see with the Heard and McDonald Islands, a small set of islands in the Indian Ocean between Australia and Africa. No one lives. That’s basically the end of this section. The United States announced a 10% tariff on a small set of islands with a population of zero.

What’s the big deal? The big deal is the sheer disregard and disrespect for trade policy that affects the every day American and, at this point, the entire world. They couldn’t have taken an additional 20 minutes to run a more comprehensive check? This further feeds the ChatGPT theory… Sounds like something the administration would ask a computer to do…

History Doesn’t Repeat But It Does Rhyme

The famous quote “history doesn’t repeat but it does rhyme”, attributed to Mark Twain, is where find find ourselves today. We’ve been here before — twice, actually.

Tariffs of Abomination in 1828 — named so because of the devastating effects it had on the southern economy.

The Smoot-Hawley Act in 1930 — worsening the Great Depression and slashing GDP by 25% in just two years.

The two cases we’ve seen of mass blanket tariffs have decimated the American economy. In Smoot-Hawley, the Great Depression had already started, but the tariffs took unemployment from 8% to 25% — one quarter of Americans in the workforce did not have jobs a mere two years into the tariff enactment. American imports dropped 66% in three years and exports fell at a similar rate of 61%. Both imports AND exports came down — which is important to note. The Trump administration wants other countries to buy more things from the United States, but blanket tariffs hurt all participants. By choking the capacity that Americans have to consume globally, tariffs will also lead to less revenue abroad, which will ultimately diminish how much other countries can buy from America even further. Other countries will also probably NOT want to buy from us because they’ll be upset about the trade war — rightfully so.

The Re-Shoring Argument

Decimating the Economy and Good Will

I think the most common argument I hear is that tariffs are good because they will bring back American manufacturing jobs. I want to touch on this, and hit on a few points along the way. The stock market had its worst day since 2020 the day after the tariff announcement. Stellantis, the auto-maker, announced a 900 person layoff because of the severity of the taxes.

The latest Institute for Supply Management (ISM) Manufacturing survey unveiled a poor outlook for factory and manufacturing activity, with respondents in machinery saying —

Business condition is deteriorating at a fast pace. Tariffs and economic uncertainty are making the current business environment challenging.

The latest Dallas Fed energy survey also showed frustration among Oil and Gas executives and others high up in the industry — here’s a quote:

The key word to describe 2025 so far is “uncertainty” and as a public company, our investors hate uncertainty. This has led to a marked increase in the implied cost of capital of our business, with public energy stocks down significantly more than oil prices over the last two months. This uncertainty is being caused by the conflicting messages coming from the new administration. There cannot be "U.S. energy dominance" and $50 per barrel oil; those two statements are contradictory. At $50-per-barrel oil, we will see U.S. oil production start to decline immediately and likely significantly (1 million barrels per day plus within a couple quarters). This is not “energy dominance.” The U.S. oil cost curve is in a different place than it was five years ago; $70 per barrel is the new $50 per barrel.

Uncertainty is expensive. There is a real cost to a future with no clear outlook. Things are not looking particularly good. All this to say, if we decimate our economy, who is going to build it back? It’s difficult to re-shore manufacturing when your entire economic base is gone. Re-shoring manufacturing also assumes that we have somewhere to export all of our production to. Who will want to buy from us when we’ve destroyed all good will with other countries?

A good example of this was in the first Trump term with the trade war against China. China was upset with the United States and their tariffs, and as a result, stopped buying American agricultural exports. Farmers were having a tough time, and the government had to step in and issue support checks totaling $28B dollars, distributed through the Market Facilitation Program, in order to compensate the farmers for the decline in agricultural sales.

Re-shoring takes time. It is a bold bet to assume that the United States can hold off for 5+ years until all the supply chains for production are built out.

Labor Market

The labor market is already doing very well. We are at record low unemployment. Who will take the jobs that the tariffs will supposedly create? How many jobs will be created? Are we nuking the economy in order to create 1,000 jobs in Detroit? Lots of unanswered questions and unplanned scenarios from the current administration. Wages for these jobs to weave t-shirts and build cars and chop wood will be driven to the ground if forced to compete globally, even if there are 20% tariffs on foreign goods.

Competition

There will be a decline in competitiveness within the United States markets by enacting these tariffs. There has to be some mechanism by which to test how efficiently and effectively you are creating your goods. Tariffs throw that out the window, and would make US production even less competitive. We could get more competitive by improving technology, pushing training programs, etc. but I mean we’re even slashing the CHIPS act now.

To Wrap It Up

There is this sentiment that working in a factory or manufacturing plant is better or more noble than working in a coffee shop or a clothing store or any other service job. The reason that a person working a minimum wage job cannot afford a house right now isn’t because of free global trade, it is because of a housing shortage and a lack of zoning reform amidst a growing population. It is policy decision after policy decision that shuts down growth. I wrote a whole thing about it last year if you’d like to read:

This Is Why You Can't Buy A House (Right Now)

Cormac McCarthy has this quote in his book All The Pretty Horses —

Lots to dive into there as well, but the United States does not find increasing wealth inequality or higher cost of living because of free trade with other countries. We are where we are because of domestic policies, or lack thereof.

As always, thanks for reading, and I hope you’re doing well.

Lucas